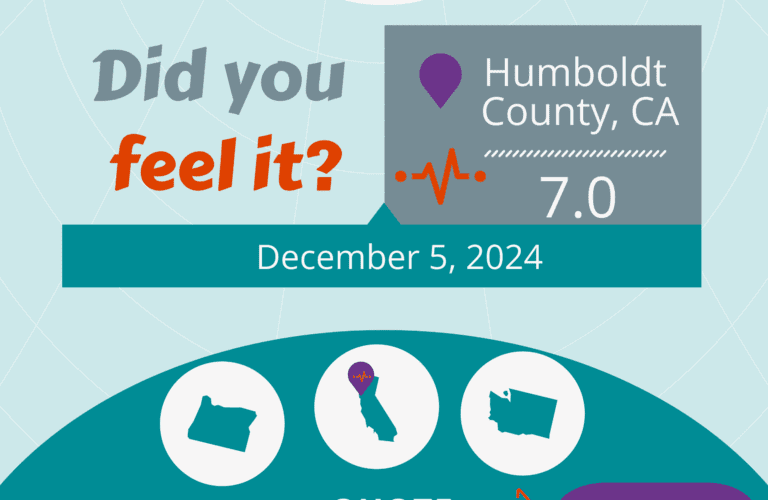

Does FEMA Cover Earthquakes?

FEMA (Federal Emergency Management Agency) provides financial assistance to individuals and families who have been affected by natural disasters, including earthquakes. The amount of assistance provided by FEMA varies depending on the extent of the damage and the resources available.

As of 2024, FEMA’s maximum assistance is only $85,000 ($42,500 for Housing Assistance + $42,500 for Other Needs Assistance). This includes assistance for temporary housing, home repairs, and other disaster-related expenses. However, this amount is subject to change and may be adjusted based on the severity of the disaster and the availability of resources. The maximum amount of assistance that FEMA can provide to an individual or household is determined by the Stafford Act, which governs federal disaster assistance programs Opens a new window.

In the case of an earthquake that destroys an entire home, FEMA may provide financial assistance to cover the costs of temporary housing and other necessary expenses. However, no amount is guaranteed and even the maximum assistance provided by FEMA will not cover the full cost of rebuilding a home. It is important to note that FEMA assistance is intended to supplement, not replace, insurance coverage. Homeowners are encouraged to have insurance policies that cover earthquake damage and to understand the specific terms and conditions of their policy.

You Probably Can't Rely Only On FEMA

Will the $85,000 maximum payout (if you were to actually receive the maximum), come close to covering the damage and expense of your house and belongings? As stated by FEMA’s own Deputy Associate Administrator for Insurance and Mitigation, David Maurstad, “Earthquakes can happen anywhere, and they can strike without warning. While it’s impossible to predict when or where the next earthquake will occur, it’s important for homeowners to be prepared. Earthquake insurance can help protect your home and your financial future in the event of a disaster. We encourage all homeowners to consider the risks and take steps to protect themselves and their families.”

To receive FEMA assistance, individuals must first register with FEMA and provide documentation of the damage to their property. FEMA will then conduct an inspection to assess the extent of the damage and determine the amount of assistance that will be provided. The process can take some time, so it is important to register with FEMA as soon as possible after a disaster.

In addition to FEMA assistance, homeowners can choose from affordable earthquake insurance options to cover the cost of repairing or rebuilding their home. The process for getting paid by an insurance company can be faster than getting assistance from FEMA, but it depends on the specific insurance policy and the extent of the damage.

Considering Insurance? See the Difference.

In the event of a disaster, homeowners may receive assistance from both FEMA and their insurance company to help cover the cost of repairs and rebuilding. Here is an example of the payments made to the insured in case of an earthquake that damages half their $1M home.

Earthquake insurance policies have a deductible, which is the amount the homeowner must pay out of pocket before the insurance company begins to cover the cost of damages. For example, if a homeowner has a 5% deductible on a $1M home and the home suffers $500,000 in damage from an earthquake, the homeowner would need to pay $50,000 (5% of $1M) out of pocket while the insurance company covers the remaining $450,000 in damages. When you compare this to the FEMA amount of up to $36,000, the decision to purchase an earthquake insurance policy seems quite simple.

QuakeInsurance by GeoVera provides top-rated insurance solutions in catastrophe-exposed areas and is the leading provider of residential earthquake insurance. Call us 1 (800) 324-6020 Opens a new window or get an instant quote now Opens a new window!