Why is Deciding to Get Disaster Insurance so Challenging?

Humans make thousands of daily decisions, ranging from simple choices like what to wear or eat, to more complex decisions like buying a house or starting a business. With the increasing complexity of our world, decision-making has become more complicated than ever.

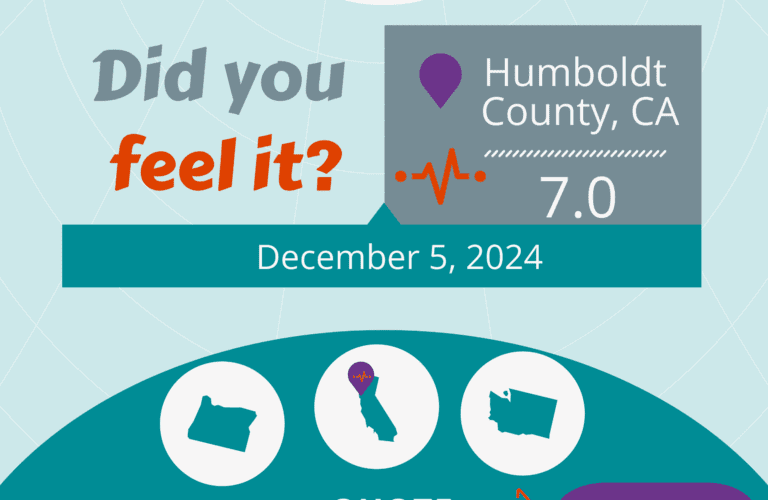

When buying insurance, many people think they don’t need to be insured against certain risks because they don’t believe an event could happen to them, one hasn’t occurred recently, or they don’t see the value in paying for something they may never use. However, the real risk from Mother Nature should be acknowledged, and that going without insurance can be a costly mistake. Several psychological factors may influence people into not buying insurance even when they know rationally that risks do exist.

Five Reasons Getting Disaster Insurance can be a Challenging Decision:

(1) Optimism Bias

People often believe they are less likely to experience negative events than others. This optimism bias can lead people to underestimate the risks and believe they do not need insurance because “bad things don’t happen to me”.

As explained by Dr. Daniel Kahneman, psychologist and Nobel Laureate in Economics, “Optimism bias is a natural tendency of the human mind to overestimate the likelihood of positive outcomes and underestimate the likelihood of negative outcomes. While it can be a useful cognitive mechanism in some contexts, it can also lead to unrealistic expectations and poor decision-making.”

(2) Availability Heuristic

People tend to base their decisions on information that is easily accessible and readily available in their minds. Suppose someone has never experienced a certain type of event or doesn’t know anyone who has experienced it. In that case, they may be less likely to consider it a real risk and, therefore, less likely to purchase insurance to protect against it.

(3) Present Bias

People prioritize immediate and long-term benefits differently. Insurance is often seen as a long-term investment without immediate benefits. This present bias can make people more likely to prioritize other shorter-term needs over the long-term financial security that insurance may provide.

(4) Fear of Loss

People often have an emotional aversion to losing something they already have. Insurance premiums represent a financial loss because people pay for something they may never use. This fear of loss can make people more hesitant to purchase insurance because they may feel like they’re giving up money now for something they may never need.