New Year, New Insights: A Guide to Reviewing Your Insurance Documents

Reviewing your insurance documents for the new year with this guide is a great way to start the year informed and prepared.

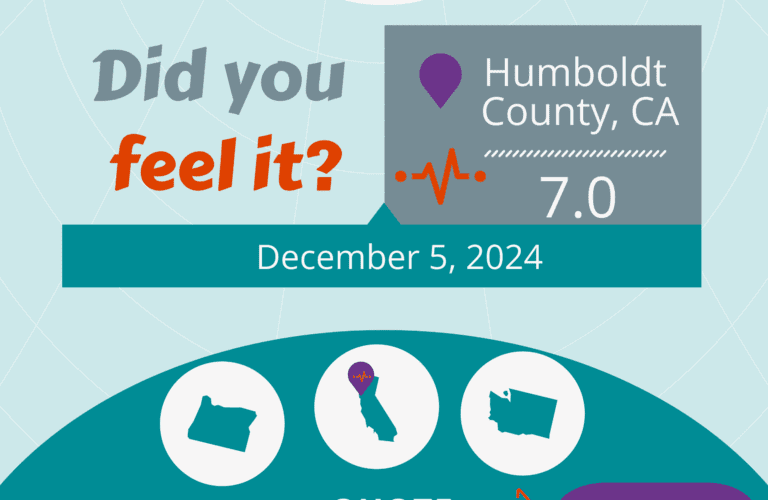

As you’ve certainly heard us state before, the standard Homeowners policy does not protect against damage from an earthquake. Adding standalone Earthquake insurance is crucial to protecting the equity that you have built up in your home. Earthquake insurance provided by QuakeInsurance by GeoVera offers flexible and affordable coverage options to protect your property in the event of an earthquake.

Earthquake policies can be tailored to suit individual needs and budgets. Homeowners can choose coverage limits, deductible amounts, and additional endorsements to align with their circumstances.

Multiple policy plans ensure California homeowners can find an Earthquake insurance plan that best fits their needs. All you will need is your home address and the dwelling limit that you will find listed on your current Homeowners policy to get a quote.

What does Earthquake insurance cover?

Let’s outline the key coverage elements for Earthquake insurance, such as coverage limits, deductibles, and exclusions. Understanding what Earthquake insurance covers can give you peace of mind, knowing that you have financial protection in case of seismic activity.

Structural Damage Coverage

One of the primary components of QuakeInsurance by GeoVeraʼs Earthquake insurance is coverage for structural damage to your home. This includes the physical structure of your house, such as the foundation, walls, roof, and other essential components. If an earthquake causes damage to your property, the insurance policy can help cover the cost of repairs or even the full reconstruction of your home, depending on the extent of the damage. Plus, there is coverage for “other structures,” the external structures not attached to your home, like a detached garage or fence, that could be damaged or destroyed in a seismic event.

Personal Belongings Coverage

In addition to protecting your home itself, GeoVeraʼs Earthquake insurance also covers your personal belongings. This includes furniture, appliances, electronics, clothing, and other possessions inside your home. If an earthquake damages or destroys your personal belongings, the insurance policy can help cover replacing or repairing them.

Loss of Use or Additional Living Expenses Coverage

If an earthquake damages your home to the extent that it becomes uninhabitable, you may need to find temporary accommodations while repairs are being made. GeoVeraʼs Earthquake insurance can help with “loss of use,” which are additional living expenses, such as hotel stays, Airbnb rental costs, or other necessary expenses until you can return home.

What is a Good Deductible for Earthquake Insurance?

One element of Earthquake insurance that is often misunderstood is the deductible. The best way to explain how the Earthquake deductible works is that if you submit a claim, the amount paid to you will be the loss amount minus the chosen deductible.

QuakeInsurance by GeoVera offers a wide range of deductibles in its products, ranging from 2.5% to 25%, and we make it easy to see quotes for all deductibles. The appropriate deductible can vary and is often influenced by your financial position and risk tolerance.

Homeowners must be informed that they have a critical gap in their insurance if they live in a seismic region and their Homeowners policy does not cover earthquake peril. With a stand-alone earthquake policy, damage sustained from an event can be covered for the dwelling, other structures, and personal property, plus loss of use, potential loss assessment, and costs associated with changing building codes. Without the right insurance in place, families need to know that they could lose their largest asset.