How You Can Build a Stronger Financial Future

Most Americans know that their home is an investment but often don’t recognize how significant of an investment it is. For many Americans, their home is not only the most essential asset they will acquire in their lifetimes but is the primary way they will build wealth. Ultimately, there is no more important financial asset to protect than the value of your home.

According to a 2019 study by the Federal Reserve, the median net worth of a homeowner in the United States was $255,000, while the median net worth of a renter was just $6,300.

Considering that as of 2023, the average home value in California is $728,000, a CA home is an even more important investment to keep secure.

When we think about our homes, they are not just a dwelling that we occupy. They are actually a kind of savings account. A tax-advantaged forced saving account that can be leveraged during many of life’s most significant financial moments. The equity in your home can be used to start a business, pay for college tuition, cover a significant medical expense, or fund your lifestyle later in life.

Many people rely on their homes to fund their retirement. A 2019 report by the Urban Institute found that the average homeowner age 65 and older had $150,000 in home equity, which accounted for about two-thirds of their total net worth. And according to a 2021 Employee Benefit Research Institute survey, 30% of workers said they plan to use the equity in their homes to fund their retirement.

Beyond retirement, using a reverse mortgage to access home equity can help older adults pay for in-home care or other long-term care needs.

How to Support the Next Generation

Beyond securing your own financial stability, transferring home ownership is also the primary way people pass that wealth in America. A 2021 report by the Joint Center for Housing Studies of Harvard University revealed that homeowners who pass their homes down to their children or other heirs could help to create a more financially secure next generation.

According to the report, the median net worth of households receiving a home transfer was $220,000 higher than that of households that did not receive a transfer. Home transfers can also reduce the likelihood of future financial hardship. Households that received a home transfer were 30% less likely to experience financial hardship than households that did not receive a transfer.

The University of California Berkeley’s Haas Institute for a Fair and Inclusive Society found that “intergenerational wealth transfers in California are primarily driven by inheritance. The study found that California’s top 10% of inheritors received more than 85% of total inheritance dollars, while the bottom 50% received less than 3%. The study notes that this concentration of inheritance can perpetuate existing wealth inequalities.”

How to Close the Racial Wealth Gap in California

White families have utilized this strategy of wealth transfer to reshape their financial landscape for generations. In contrast, families of color were deliberately excluded from building wealth in this way through the use of local, state, and federal policies. Understanding these historical dynamics can help us see why the racial wealth gap remains a feature of American life.

According to the 2021 report by the Joint Center for Housing Studies of Harvard University, 74% of homeowners who passed their homes down to their children between 2014 and 2019 were White, while 10% were Black and 10% were Hispanic. Significantly, homeownership can help to reduce racial wealth disparities between generations. According to the report, the median net worth of Black households that received a home transfer was $100,000 higher than that of Black households that did not receive a transfer.

A 2022 report from the California Association of Realtors (C.A.R.) found that in the California market, “Black and Latino households who can afford to buy are half that of whites, illustrating a wide racial homeownership divide.” A Census Bureau’s American Community Survey found that “the 2020 homeownership rate for all Californians was 56 percent, 64 percent for whites, 61 percent for Asians, 46 percent for Hispanics/Latinos and 37 percent for Blacks.”

The data tells us that if we desire to close the nation’s racial wealth gap, the place to start is homeownership. We need to support lending to families of color, and once families get into properties, we need to protect those assets.

In 2021, Governor Newsom and the C.A.R. sponsored three bills passed into law. These bills require implicit bias training for real estate professionals, address the supply and affordability challenges that disparately impact people of color, and address appraisal bias.

“Promoting access to homeownership is one way to close the racial wealth gap and foster economic equity for all Californians,” C.A.R. President Otto Catrina said. “That’s why C.A.R. is committed to addressing ongoing fair housing and equity issues that persist in our state that have made it harder for Blacks, Latinos, and other underserved communities to access and afford housing.”

Benefits of Owning vs. Renting in California

The difference between owning a home and renting a property is staggering regarding lifetime wealth generation.

However, a report from the Public Policy Institute of California reveals that homeownership rates in California are the second lowest in the country. Statewide, only 56% of households own their home, compared to 65% in the rest of the country.

While renting certainly has its advantages, such as outsourcing maintenance and lawn care, if you decide to invest in a home, not only will you come out ahead, you will come out way ahead.

The wealth gap between homeowners and renters is growing. According to a 2021 report by the National Association of Realtors, the median net worth of homeowners in 2019 was 40 times higher than the median net worth of renters.

And yes, interest rates have been on the rise, but historically, they are still incredibly low. So if you can sock away enough savings for a down payment, in the long run, it will be worth it. And if you are a first-time homebuyer and California resident, you may be eligible for a $10,000 grant toward your down payment through the California Association of Realtors.

How to Protect Your Most Valuable Asset

It is essential to protect your most valuable asset; that is where a company like QuakeInsurance by GeoVera has your back.

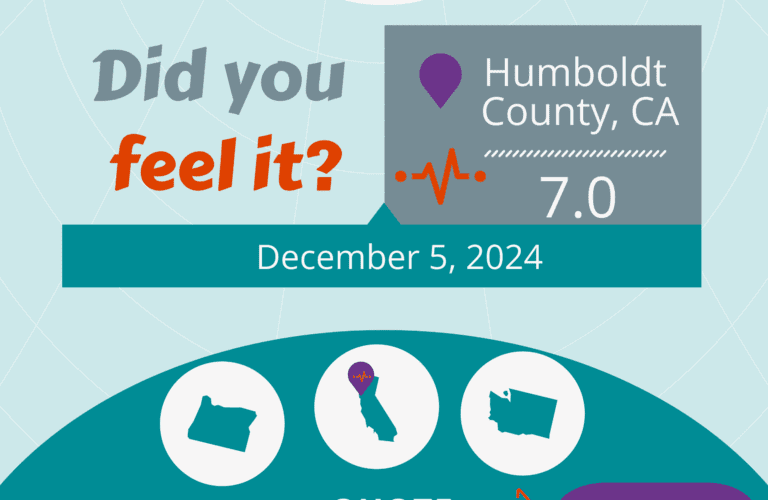

Here in the West, the threat of an earthquake can loom as a devastating prospect, which could lead to financial ruin for you and your family. According to the Insurance Information Institute, the 1994 Northridge earthquake in California caused an estimated $15.3 billion ($26.4 billion in 2018 dollars) in insured losses.

Many homeowners do not have earthquake insurance despite the potential for significant damage. A 2020 survey revealed that only 23% of homeowners who had homeowners insurance said they had earthquake insurance. And while homeowners in the West were most likely to have earthquake insurance, still only 28 percent have coverage. And if you think you can rely on FEMA to protect your investment, think again. As of 2024, FEMA’s maximum assistance is only $85,000 ($42,500 for Housing Assistance + $42,500 for Other Needs Assistance).

But it doesn’t have to be that way. You can protect your home, your family, your wealth, and your future by asking your insurance agent about earthquake coverage or getting an instant quote and purchasing directly from Quake Insurance.