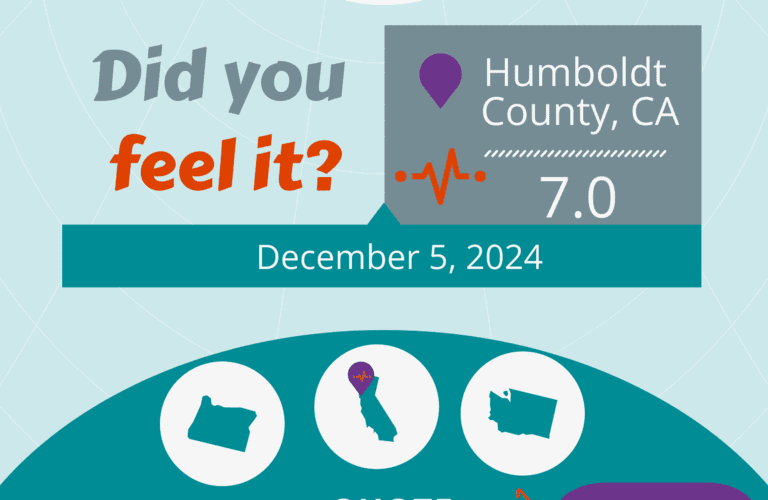

California is known for its stunning landscapes and beautiful coastline. It is also a region notorious for its seismic activity Opens a new window. Given the constant earthquake risk, homeowners frequently contemplate whether acquiring earthquake insurance can provide them with financial security. This article delves into the options for earthquake insurance availability in California, underscores its significance, and outlines key factors for homeowners to weigh when navigating this vital choice.

Can you buy Earthquake Insurance in California?

Yes, you can buy earthquake insurance in California. The state of California is one of the most earthquake-prone regions in the United States, making it a wise investment for homeowners and renters to consider earthquake coverage. Many insurance providers offer earthquake insurance as an optional add-on to their existing homeowner’s policies or as a separate standalone policy.

Do I Need Earthquake Insurance in California?

For California residents, earthquake insurance is not mandatory but highly recommended. California is prone to seismic activity and earthquakes that can cause significant damage to properties and belongings. Standard homeowner’s insurance policies typically do not cover earthquake damage, so having separate earthquake insurance can provide financial protection in the event of an earthquake.

Before deciding, it’s important to consider factors such as the location of your property, its construction type, the potential risk of earthquakes in your area, and your financial ability to cover possible damages. With earthquake insurance, homeowners could handle substantial financial burdens to repair or rebuild their homes, replace belongings, and cover temporary living expenses. Discussing your options with an insurance provider can help determine if earthquake insurance suits your needs and circumstances.

Renters in California should consider getting earthquake insurance to protect their belongings because standard renters insurance usually doesn’t cover earthquake-related damages. The risk of property damage from earthquakes is significant in earthquake-prone areas like California. Having earthquake insurance can provide financial security and help cover the cost of repairs or replacement of belongings in case of earthquake-related incidents, so it is important to not always go with the cheapest earthquake insurance but to ensure a financially stable insurer.

How much does Earthquake Insurance in California Cost?

The cost of earthquake insurance in California could range from a few hundred dollars to several thousand dollars per year, depending on various factors. These factors include your property’s location and value, construction type, coverage limits, and the deductible you choose.

What is a Reasonable Deductible for Earthquake Insurance?

The appropriate deductible for earthquake insurance can vary depending on factors such as your financial situation and the cost of your property. Generally, our deductibles range from 2.5% to 25% of the property’s insured value. Consider your risk tolerance and ability to cover the deductible when selecting a suitable amount. It’s advisable to consult with an insurance professional to determine the best deductible for your specific circumstances.

Do Most People in California have Earthquake Insurance?

About 15% of California homeowners have earthquake insurance.

Is CEA the only Earthquake Insurance?

The California Earthquake Authority (CEA) Opens a new window is not the only earthquake insurance provider. While CEA is a prominent and government-backed organization offering earthquake insurance policies in California, private insurance companies like Amica Opens a new window, Allstate Opens a new window, Farmers Opens a new window, Liberty Mutal Opens a new window, Nationwide Opens a new window, and GeoVera also offer earthquake coverage. These private companies might have different policy terms, coverage options, and pricing. Researching and comparing options from CEA and private insurers is recommended to find the earthquake insurance policy that best suits your needs and budget.

Purchasing affordable earthquake insurance can be essential in earthquake-prone California to safeguard your home and assets. By understanding the coverage options, assessing the risk, and considering your financial situation, you can make an informed choice that offers protection and peace of mind during seismic events. Remember to consult insurance professionals to find the most suitable earthquake insurance policy for your needs. Preparing for the unexpected can make all the difference when protecting your home and loved ones in the face of natural disasters.

Want to get a fast and easy quote for your property? See the best options for earthquake insurance for your property in less than a minute.