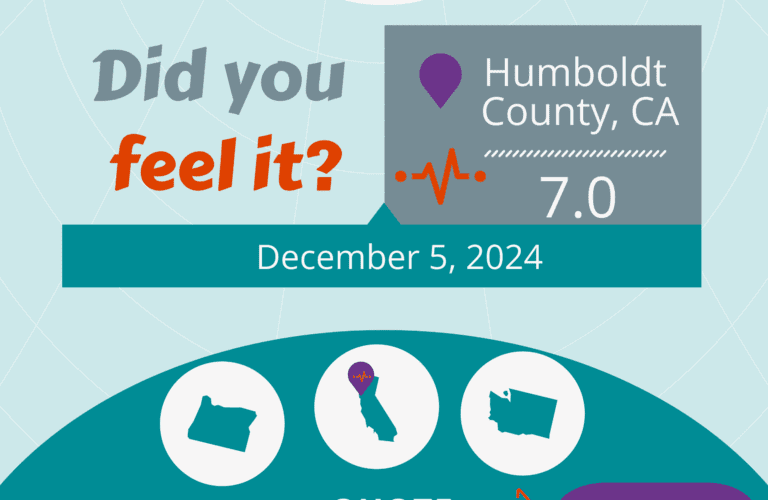

Natural disasters like hurricanes, earthquakes, and floods can cause widespread devastation in a matter of minutes. While the immediate effects of these events are often evident, the aftermath can also bring about unexpected consequences in the form of a demand surge. In this blog, we will explore how demand surge works when a natural disaster strikes, and what insurance customers should be aware of when it comes to handling the financial implications of such events.

What is Demand Surge?

- Immediate need for essentials: Affected populations require basic necessities like food, water, clothing, and shelter, leading to increased demand and potential shortages.

- Damage to infrastructure: Disruptions to local infrastructure can cause localized shortages and drive up prices.

- Reconstruction and repair: Extensive damage necessitates increased demand for construction materials, labor, and related services.

- Insurance payouts: Insurance companies make large payouts to policyholders, leading to increased spending on goods and services.

- Government aid and relief: Financial assistance and resources from the government Opens a new window can further contribute to increased demand in the affected area.

- Speculation and price gouging: Some individuals may try to take advantage of the situation by inflating prices on essential goods and services.

What Insurance Customers Need to Know About Demand Surge

As an insurance customer, it is essential to understand how demand surge can impact your claim and recovery process. Here are some key points to keep in mind:

- Adequate coverage: Ensure your insurance policy provides sufficient coverage to account for potential cost increases due to demand surge Opens a new window. Review your policy limits and consider adjusting them if necessary.

- Replacement cost vs. actual cash value: Understand the difference between replacement cost and actual cash value coverage. Replacement cost coverage provides for the cost to rebuild or replace your property without depreciation, while actual cash value coverage factors in depreciation. Replacement cost coverage can help protect you from the increased costs associated with demand surge.

- Document damages: Be thorough in documenting damages to your property, as this can help expedite the claims process and ensure you receive an accurate payout.

- Be patient: Understand that rebuilding and repairing may take longer than usual due to increased demand for materials and labor. Be prepared for potential delays in the recovery process.

- Beware of price gouging: Be cautious of contractors or suppliers who inflate prices for goods and services in the aftermath of a natural disaster. Report any suspected price gouging to local authorities.

Demand surge is a critical factor to consider for insurance customers when shopping for a policy and then in the wake of a natural disaster. By understanding how it works and taking steps to protect yourself, you can better navigate the recovery process and ensure your insurance coverage is adequate to address the increased costs associated with rebuilding and repairing your property.

Stay informed and be prepared to face the financial implications of natural disasters with confidence. If your property is at risk for earthquake, it’s time to get a quote online from QuakeInsurance Opens a new window.