The pros and cons of earthquake insurance depend on various factors, including location, financial situation, and risk tolerance. Here are some points to consider when deciding if earthquake insurance is worth it for you:

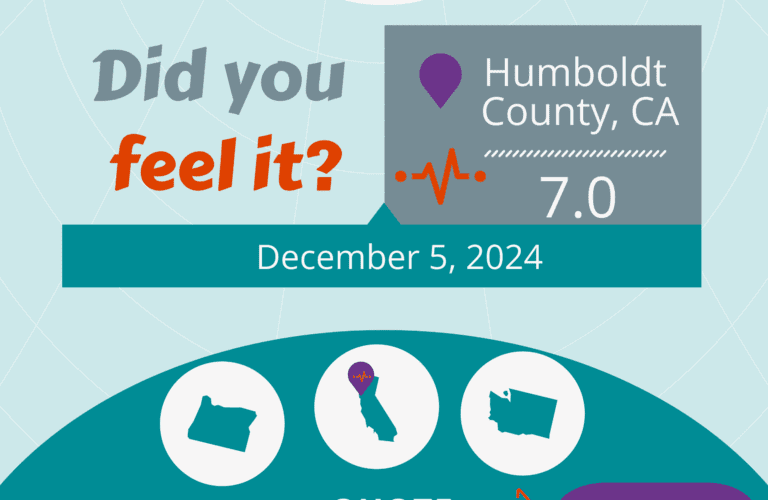

- Location: If you live in an earthquake-prone area, such as California, where the risk of seismic activity is high, earthquake insurance could provide valuable financial protection.

- Cost of Rebuilding: Consider the potential cost of rebuilding your home and replacing your belongings in case of earthquake damage. If these costs would be burdensome or unaffordable without insurance, it might be worth getting coverage.

- Financial Situation: Evaluate your ability to cover out-of-pocket repair and rebuilding costs. If you cannot handle these expenses comfortably, earthquake insurance could be beneficial.

- Peace of Mind: Having earthquake insurance can provide peace of mind, knowing you are financially prepared for a significant earthquake.

- Personal Risk Tolerance: Assess your comfort level with risk. Insurance might be worth considering if facing substantial costs due to earthquake damage concerns you.

- Building Retrofitting: If your home is not earthquake-resistant, you can factor in the cost of retrofitting or reinforcing your property. Earthquake insurance could complement these efforts.

- Local Regulations: Some areas have building codes that require certain seismic retrofitting. Understanding local regulations can help inform your decision.

Gathering information, obtaining quotes from insurance providers, and potentially consulting with an insurance professional to make an informed decision based on your circumstances is recommended.

How Much Coverage Do I Need?

The amount of earthquake insurance you need depends on several factors, including the value of your property, the cost of rebuilding your home, the value of your belongings, and your financial situation. Here are some steps to help you determine how much earthquake insurance you need:

- Evaluate Rebuilding Costs: Calculate the cost of rebuilding your home in case of a total loss due to an earthquake. This should include construction costs, materials, labor, and any additional expenses related to earthquake-resistant features.

- Assess Personal Belongings: Estimate the value of your personal belongings, including furniture, electronics, clothing, and other possessions. This will help you determine the coverage limit needed for your belongings.

- Consider Additional Living Expenses: If your home becomes uninhabitable after an earthquake, you might need temporary accommodations. Factor in the cost of additional living expenses, such as hotel stays and dining out, when determining coverage.

- Calculate Deductibles: Opting for a lower deductible will result in higher premiums. Conversely, if you choose a higher deductible, you will pay a lower premium. If you submit a claim, the amount paid to you will be the loss amount minus the deductible.

- Consult an Insurance Professional: Speak with an insurance agent or broker specializing in earthquake insurance. They can guide you based on your circumstances and help you select the appropriate coverage limits.

Remember that earthquake insurance aims to ensure you have sufficient coverage to rebuild your home and replace your belongings in the event of a significant earthquake. It is better to err on the side of caution by having slightly more coverage than you might need to avoid being underinsured.

How Much is Earthquake Insurance?

The cost of earthquake insurance can vary widely based on several factors, including:

- Location: Areas with higher seismic activity might have higher premiums.

- Value of Property: The cost to rebuild your home will influence the premium.

- Deductible: A higher deductible can lower your premium.

- Coverage Limits: Higher coverage limits will result in higher premiums.

- Type of Structure: The type of construction and its earthquake resistance can affect the cost.

- Age of Property: Due to potential structural vulnerabilities, older homes might be more expensive to insure.

As a rough estimate, earthquake insurance premiums can range anywhere from a few hundred dollars to a few thousand dollars annually. That is why getting personalized quotes from insurance providers is essential to understand the cost based on your circumstances.

Is Earthquake Coverage Worth It?

Determining whether earthquake insurance is worth it depends on your circumstances and priorities. Here’s a balanced view to help you decide:

Reasons to Consider Earthquake Insurance:

- High-Risk Areas: If you live in a region prone to earthquakes, like CaliforniaOpens a new window, the likelihood of experiencing seismic activity is greater, making insurance more valuable.

- Financial Protection: Earthquakes can cause substantial damage to your property and belongings. Insurance ensures you will be able to handle overwhelming repair and replacement costs.

- Peace of Mind: Having coverage provides peace of mind, knowing you’re prepared for the financial consequences of a seismic event.

- Personal Risk Tolerance: If covering potential earthquake-related expenses is concerning, insurance can mitigate that worry.

In the end, evaluate your financial situation, location, property and belongings’ value, and risk tolerance. If earthquake-related expenses could cause significant financial strain, insurance could be worthwhile. Research insurance options, get quotes, and make an informed decision that aligns with your needs and priorities.

With insurance in place, you’re ready to handle the aftermath without worrying about the financial strain. And finally, insurance can expedite your recovery process, helping you repair or replace your property and belongings sooner. By investing in earthquake insurance today, you’re making a proactive choice to secure your assets, minimize financial stress, and ensure your family’s well-being in the face of unpredictable seismic events.

There are many options to choose from when it comes to finding the best and most affordable earthquake insurance. If you’d like to compare rates, do it today! Quake Insurance by GeoVera makes getting a quote quick and easy.