In the aftermath of an earthquake, the impact on personal belongings can be just as devastating as the structural damage to a home.

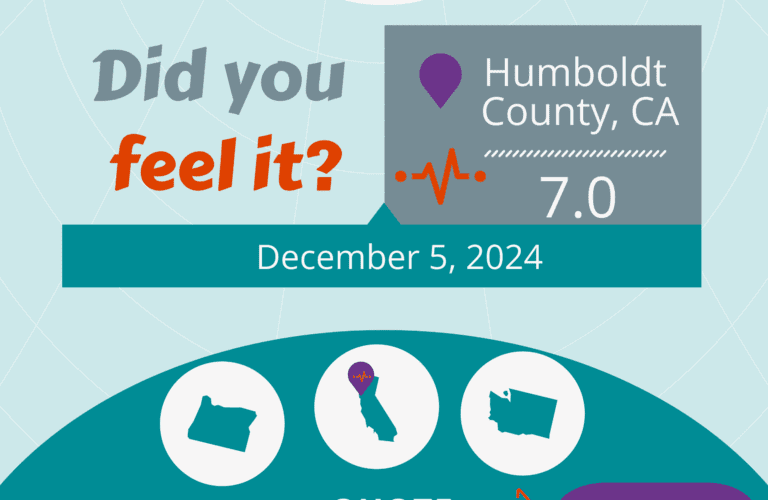

A standalone Earthquake policy with QuakeInsurance from GeoVera covers more than just the structure of your home; it also extends to your personal property. This coverage helps mitigate the financial burden of repairing or replacing items damaged or destroyed during an earthquake.

What Does Personal Property Coverage Include?

• Household Items: This includes furniture, appliances, electronics, and other everyday items found in your home.

• Clothing and Apparel: Your wardrobe is a significant investment. Earthquake insurance can help cover the cost of replacing clothing and personal accessories damaged in a quake.

• Electronics: From televisions to computers, earthquakes can wreak havoc on your electronic devices. Personal property coverage ensures that you can replace these items without bearing the full financial burden.

The Importance of Personal Property Coverage

While structural damage to a home is often the primary concern following an earthquake, losing personal belongings can also be emotionally and financially devastating. Personal property coverage provides peace of mind, knowing that your cherished possessions are safeguarded in the event of a disaster.

Tips for Maximizing Personal Property Coverage

- Take Inventory: Documenting your personal belongings through photographs or a detailed inventory can streamline the claims process and ensure that you receive adequate compensation for your losses.

- Review Policy Limits: Understand the coverage limits of your earthquake insurance policy to ensure that it adequately protects your personal property. Consider purchasing additional coverage if necessary.

- Understand Exclusions: Familiarize yourself with any exclusions or limitations within your policy to avoid surprises when filing a claim.

- Update Coverage Regularly: As your personal belongings evolve, so should your insurance coverage. Review your policy annually to ensure that it accurately reflects the value of your possessions.

Earthquake insurance for personal property and contents is vital to comprehensive disaster preparedness. Many find that the damage to their contents items are more personal and more devastating than the damage to the dwelling. By understanding the coverage options available and taking proactive steps to protect your belongings, you can mitigate the financial impact of an earthquake and focus on rebuilding and recovery.