Selecting the right deductible for your earthquake insurance policy involves balancing financial responsibility and preparedness. Your choice can significantly impact your out-of-pocket expenses in the event of a seismic event, making it a decision worth careful consideration. Let’s delve deeper into understanding what constitutes a suitable deductible for earthquake insurance and how you can tailor it to your unique circumstances.

A Guideline for Choosing Deductibles

When determining an optimal deductible for affordable earthquake insurance, it’s wise to adhere to a general guideline: opt for a deductible amount that you can comfortably manage in the aftermath of an earthquake-related claim. While choosing a higher deductible to lower your premium payments is tempting, you must remember that this also means you’ll need to cover a more substantial portion of the repair or rebuilding costs yourself.

The Financial Landscape

Take stock of your financial situation before making a decision. Ask yourself: What amount can you realistically afford to pay if an earthquake occurs and you need to file a claim? The purpose of earthquake insurance is to alleviate financial stress during times of crisis, so ensure that your deductible aligns with this goal.

Calculating the Deductible Percentage

Earthquake insurance deductibles are often calculated as a percentage of your insured property’s value. The percentage typically ranges from 2.5% to 25%. To illustrate, consider a property with a $400,000 insured value and a 10% deductible. In the event of a claim, you would be responsible for $40,000 before the insurance coverage kicks in.

Balancing Premiums and Deductibles

Keep in mind that there’s a trade-off between deductible amounts and premium costs. While a higher deductible may result in lower premiums, it also means a more substantial financial burden in the event of a claim. Conversely, a lower deductible could mean higher premiums, albeit with a reduced out-of-pocket expense during a claim.

Considering Geographical Factors

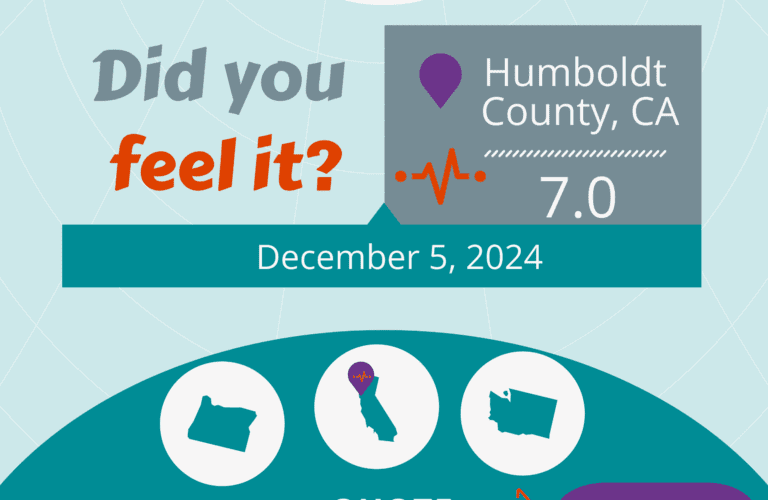

The location of your property plays a significant role in determining the appropriate deductible Opens a new window. If you reside in an area with higher seismic activity and a history of earthquakes, it might be prudent to lean towards a lower deductible to ensure comprehensive coverage. Conversely, regions with lower earthquake risks might offer room for a slightly higher deductible to achieve premium savings.

The Expert’s Insight

Consulting an insurance professional can provide valuable insights into determining the right deductible for your circumstances. These professionals can evaluate your financial readiness, analyze your risk exposure, and guide you toward a deductible that offers a healthy balance between financial comfort and protection.

Why Are Earthquake Deductibles So High?

Earthquake deductibles tend to be higher than other insurance types due to the unique risks associated with seismic events Opens a new window. Earthquakes can cause widespread and catastrophic damage, resulting in costly claims for insurance companies. High deductibles help insurers manage financial risks and keep earthquake insurance coverage accessible.

What Percentage is an Earthquake Insurance Deductible?

Earthquake insurance deductibles are usually expressed as a percentage of the insured property value. This percentage can vary between policies and insurers. It’s crucial to understand how the deductible percentage applies to your specific policy to avoid any surprises during the claims process.

The 10% Earthquake Deductible Explained

The 10% earthquake deductible often refers to a deductible that is 10% of the insured property value. This means that if your property is insured for $500,000, you would have a deductible of $50,000 for earthquake-related claims.

The 10% deductible provides several benefits to both insurance providers and policyholders. For insurance companies, it assists in managing their financial exposure, enabling them to fulfill their commitments to policyholders across the board. For policyholders, the 10% deductible structure offers a predictable framework for understanding their financial responsibilities in the event of an earthquake-related claim.

It’s important to note that while the 10% earthquake deductible is a common framework, it can be adjusted to meet your specific needs. Some policies might offer higher or lower than 10% deductibles, depending on your preferences and financial situation. When customizing your earthquake insurance coverage, it’s essential to consult with insurance professionals who can guide you toward a deductible that aligns with your financial capacity and risk tolerance.

Why is My Earthquake Insurance So Expensive?

The cost of earthquake insurance is influenced by several factors, including the location of your property, its value, construction type, coverage limits, and desired deductibles. Regions with higher seismic activity, such as California, can increase premiums Opens a new window. However, the peace of mind and financial protection earthquake insurance provides can outweigh the cost.

Why Not to Buy Earthquake Insurance?

While earthquake insurance offers substantial benefits, some individuals might consider forgoing it due to perceived costs or low perceived risk. However, weighing the potential financial consequences of not having coverage is crucial. In earthquake-prone areas like California, the potential costs of repairing or rebuilding a home after a seismic event can far exceed the cost of insurance premiums.

The choice of deductible is a crucial aspect of earthquake insurance, as it directly affects your out-of-pocket costs in case of a claim. Balancing affordable earthquake insurance and financial preparedness is essential when selecting a deductible. While earthquake insurance may be expensive, it’s an investment in safeguarding your property and economic well-being, and it is important to consider all of the options, not just the cheapest earthquake insurance.

Considering factors like deductible amounts and coverage limits in conjunction with your personal circumstances will help you make an informed decision. Remember, reputable insurers like Quake Insurance by Geovera offer options that cater to your specific needs, ensuring you’re prepared for the unexpected while staying within your budget.

Want to get a fast and easy quote for your property? See the best options for earthquake insurance for your property in less than a minute.