The average cost of earthquake insurance varies depending on multiple factors, including the property’s location, value, construction type, and the desired coverage level. Generally, earthquake insurance premiums fall within 1% to 5% of the property’s insured value. Opens a new window For instance, if your home’s insured value is $400,000, your annual earthquake insurance premium may be between $4,000 and $20,000.

It’s essential to remember that regions with higher seismic activity often face higher premiums due to the increased risk of damage. Conversely, areas with lower earthquake risks may have more affordable premiums.

What is a good deductible for earthquake insurance?

The deductible for earthquake insurance refers to the amount the policyholder must pay out of pocket before the coverage occurs. Geovera calculates earthquake insurance deductibles based on the property value. Deductibles typically range from 2.5% to 25% of the property’s insured value.

Selecting an appropriate deductible hinges on your financial capacity and risk tolerance. Opting for a higher deductible can lead to lower premiums, but it also means you would bear a higher cost in case of a claim. Conversely, a lower deductible results in higher premiums, making it more manageable to cover expenses if an earthquake occurs.

How are earthquake insurance deductibles calculated?

Earthquake insurance deductibles are calculated based on the property value. The deductible percentage is applied to the property’s insured value, and that amount becomes the out-of-pocket expense the policyholder must pay when making a claim. For example, if your home is insured for $500,000 and you have a 10% deductible, you would be responsible for paying $50,000 for earthquake-related damages before the insurance coverage begins.

How much does earthquake insurance cost?

Various factors influence the cost of earthquake insurance. Geovera’s Quake Insurance provides competitive rates tailored to meet your specific requirements.

To obtain an accurate estimate, consider requesting a quote from Quake Insurance by GeoVera, considering factors like location, property value, construction type, and desired coverage level. The team of experts at Geovera can assist you in customizing a policy that aligns with your budget and provides adequate protection.

Is earthquake insurance worth it for renters?

Earthquake insurance is not solely limited to homeowners; renters can benefit from its protection. Although renters do not own the building, they often possess valuable belongings that could be damaged or lost during an earthquake. Geovera’s Quake Insurance for renters covers personal belongings, temporary living expenses, and liability protection in case of damage to others.

While the property owner’s insurance might cover the building’s structure, it generally does not extend to personal belongings. Earthquake insurance for renters is a wise investment to protect your possessions and avoid potential financial strain after an earthquake.

How are earthquake insurance deductibles calculated?

Earthquake insurance deductibles are calculated based on the property value. The deductible percentage is applied to the property’s insured value, and that amount becomes the out-of-pocket expense the policyholder must pay when making a claim.

What percentage of people have earthquake insurance?

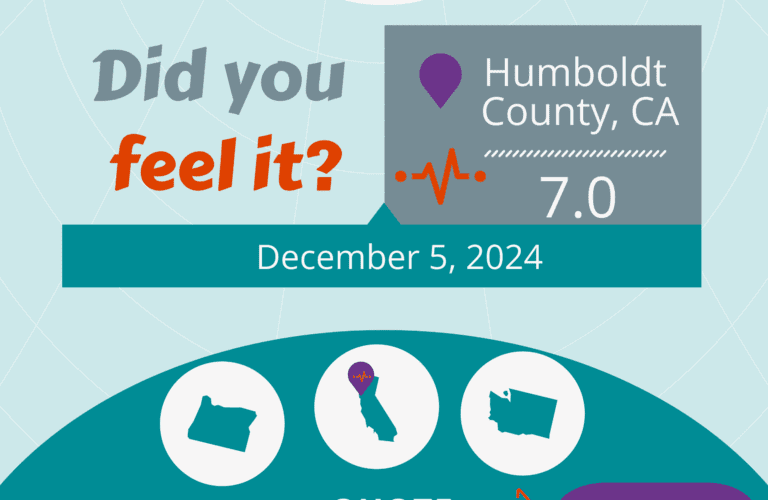

The percentage of people with earthquake insurance varies across different regions. Several factors, including the level of seismic activity, local regulations, and the general perception of earthquake risks influence it. In California, for example, known for its seismic activity Opens a new window, a higher percentage of homeowners tend to have earthquake insurance compared to regions with lower earthquake risks.

Homeowners and renters in earthquake-prone regions should seriously consider affordable earthquake insurance from Quake Insurance by Geovera. Earthquake insurance offers comprehensive coverage tailored to protect your property and belongings during an earthquake, providing peace of mind and financial security during uncertain times.

Want to get a fast and easy quote for your property? See the best options for earthquake insurance for your property in less than a minute.